Gold. The shiny yellow metal represents diverse things to different people and cultures. It is one of the most coveted assets and the most sought-after among precious metals. A commodity such as gold, which has uses in fields as diverse as investing, jewelry, medicine, and electronics, naturally is high in demand. That is reason enough to push its price sky-high.

After the discontinuation of the Bretton Woods system in 1970, the gold rate rose from USD 35/ounce to cross USD 2,000/ounce in August 2020. That is a whopping 5614% increase in 50 years. Whether the next 50 years will witness as much increase in the gold rate is debatable but most financial experts agree that the gold rate will continue on its upward trajectory, barring unforeseen circumstances.

What are the factors leading to the skyrocketing of gold prices? Let us explore this topic further.

9 Factors Affecting Gold Prices

Gold is one of the unique commodities whose price is affected by a plethora of seemingly unrelated global variables. The price of gold is intimately linked to the US Dollar even after abandoning the gold standard and the Bretton Woods System. The other determinants include direct factors like inflation, currency depreciation, supply and demand, and economic uncertainties as well as indirect and complex causal elements like economic data and monetary policy.

1. Demand

One of the basic factors driving the price of any commodity, demand for gold has a major influence on its value. Almost half of the annual gold demand comes from the jewelry industry. India, China, and the United States are the largest consumers of gold jewelry by volume. The precious metal is much in demand as an investment in the form of bullion bars and coins.

The rest of the gold demand is rounded off by industries and the technological sector. Gold is used in the manufacture of electronic gadgets like GPS devices and medical equipment like stents. Gold compounds are used in the treatment of rheumatoid arthritis and cancer. Gold nanoparticles are integral to Rapid Diagnostic Tests (RDTs).

Demand for gold in all these sectors has been rising constantly and so is the price of gold.

2. Production Of Gold

Another basic factor determining the price of any commodity is its supply in the market. Annual gold production is intricately linked to mining in existing mines and discovering potential deposits. China, Russia, Australia, the United States, Canada, Peru, Ghana, and South Africa are the top producers of gold in the world.

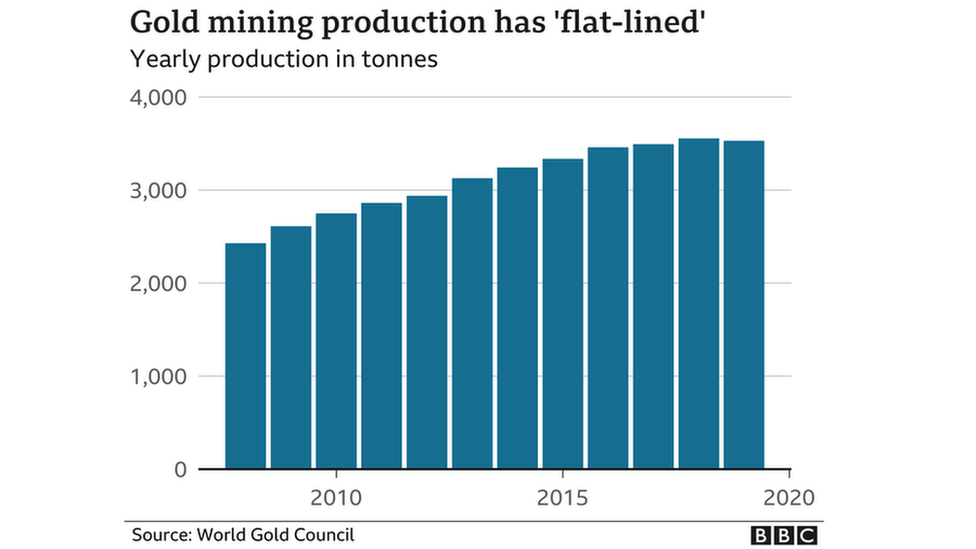

From 2,470 metric tons in 2005, the production of the gilded metal has risen steadily, partly as a response to the global recession. In 2019, 3519 metric tons of gold were mined which is a 1% dip y-o-y, a first decline, though minor, in the 15-year period.

The global gold production is displaying a plateauing trend in the last five years. The reason for this may be attributed to the decline in the availability of ‘easy’ gold, the deposits closer to the surface of the earth. As surface deposits are drying up, to keep up the production, miners are targeting deeper reserves, which is arduous and costly in addition to being hazardous and resulting in environmental damage. This extra expense is adding to the price.

As the gold demand continues to increase, the stagnating supply is leading to rates rise.

3. Central banks

Central banks of countries hold gold and foreign exchange reserves as backing to their own currencies. Various scenarios prompt the central banks to diversify their monetary reserves in foreign exchange into gold. As they buy gold in large quantities, the market price of gold would witness a huge spike.

Central banks may also buy gold to protect the purchasing power of their own currencies in the event of inflation, currency depreciation, market volatility, and economic uncertainties. For the first time in a decade, some central banks of gold producing countries sold part of their gold reserves in 2020 to exploit the record gold rates and to soften the economic fallout of the COVID-19 pandemic.

Whether buying or selling, central banks play a major role in determining the gold rate.

4. The U.S. Dollar

As the U.S. Dollar is the global reserve currency, gold is dollar-denominated. This means the value of the U.S. Dollar and gold rate has an inverse relationship. A strong U.S. Dollar can keep the gold price steady and stable. A weak USD tends to drive gold prices higher, as the gold demand increases since more gold can be bought for the same price.

Typically strengthening US Dollar is an indication of an expanding economy and inflation is almost always a byproduct of it. When the economy is growing, the money supply increases, diluting the value of the existing currency and making everything more expensive, including gold.

The U.S. Federal Reserve increase lending rates as a way to rein in out-of-control prices. Increasing lending rates is bound to bring down the money supply in the system. This balancing act by the Federal Reserve has a profound impact on gold prices.

This makes gold a hedge against inflation. As the value of the U.S. Dollar depreciates, prices of commodities rise. This is inflation. As inflation rises, so does gold prices.

You may be interested to know “Why does gold have value“

5. Economic turbulence

This includes various elements influencing the marketplace. As the health of the economy oscillates, so do the gold prices.

Exactly what causes an upheaval in the system is hard to predict. Anything from internal political uncertainties to international trade wars, tumbling oil prices, and instability in the financial markets can lead to unpredictability in the system.

When a cloud of uncertainty envelops the economy, investors tend to favor gold. The historical performance of gold in troubled times helps in strengthening the belief that gold will provide an effective hedge against inflation and any other fallouts of a teetering system. All prominent national and international events have a consequential impact on the economy.

As the economy wavers, demand for gold goes up along with its value.

6. Wealth protection

During economic turbulence, people tend to favor gold as an investment as its prices are known to move in a trajectory opposite to that of paper investments like stocks and real estate. When there is a decline in either or both the expected and actual returns on financial assets like equities, bonds, and mutual funds, gold as an investment choice looks attractive and gains traction. Any increase in interest in gold is bound to lead to a hike in its value.

Gold is a hedge against the negative impacts of economic predicaments like inflation, depreciation, and devaluation. It can also act as a buffer against the economic fallout of political uncertainties. Again, the increased interest in the metal leads to rates rise in gold.

7. Investment

Gold as an investment vehicle comes with myriad advantages. For this reason, industry experts advise investors to include gold in either physical or paper form to be part of an investment portfolio as a way to balance its risk and reduce volatility. In addition to physical gold bullion, investors have the option to buy gold mining stocks, gold mutual funds, gold ETFs and other gold-related paper investments.

As more and more investors understand the potential of including gold in the portfolio and opt for these investment choices, the demand for gold will increase. And, as the demand for gold goes up, so does its price.

8. Economic data

The economic figures compiled and released by the Federal government has an indirect impact on gold prices. Unemployment figures, manufacturing figures, wage statistics, job reports, and even the GDP growth rate, which is an indicator of the health of the economy, affect gold rates.

These statistics form the basis for the monetary policy of the Federal Reserve. Lower unemployment, expanding manufacturing sector, growing job market, and a GDP growth above 2% may lead to a tightening of the monetary policy. This may result in bringing down gold prices, though none of these are set in stone.

On the other hand, a weaker job market, rising unemployment, contraction in manufacturing, and below-par GDP growth may result in a dovish monetary policy on interest rates. This may push up gold prices.

9. Monetary policy

The monetary policy of the Federal Reserve has a powerful impact on the price of the precious metal. The goal of the monetary policy is to promote maximum employment, stable prices, and moderate long-term interest rates. One of the basic tools used by the Federal Reserve in implementing its policy goals is interest rates.

Interest rates have an immense impact on the gold rates due to the weighing in of the opportunity cost. It is the lost notional profit when an alternative is selected over another. The concept of opportunity cost is a reminder for investors to weigh all choices before making the decision. In this context, the choice an investor has to make is between buying gold and investing in other alternatives that offer guaranteed returns.

As the interest rates go up, investors would be tempted to place their savings in CDs and bonds rather than gold, as they offer more guaranteed returns compared to no returns from gold. The opportunity cost is higher for gold in this scenario. In the other instance, when the interest rates are less attractive, the opportunity cost is nominal, as the yield from traditional investment choices is low. In this scenario, investing in gold would be a better alternative. The investor would find it easier to forgo the nominal interest for more attractive returns from gold.

Any of the factors listed above may affect gold prices. In 2020, the gold rate crossed the $2,000/ounce threshold and hovering in the higher end mostly due to the panic and uncertainties triggered by the COVID-19 pandemic. The increasing tensions in the US-China relations and the possibility of a full-blown trade war have only aided this trend.

The threat of another global recession, depreciating U.S. Dollar, and a slew of discernable and hidden factors are driving up the gold price and helping in maintaining it in the higher end. How long this trend will continue remains to be seen.

Gold is a physical commodity that is traded in the international bullion market and its price varies constantly based on many factors. The live price of the yellow metal in the international bullion market, known as the spot price, fluctuates continually when the market is in session.

The current spot price of gold is $1,856.25/ounce as of 27 December 2020.

However, the real worth of gold is a more difficult question to answer. The spot price includes the cost of production of gold, including mining, compliance, and other associated costs such as marketing. As the gold price skyrockets, investors and industry insiders are questioning the logic behind its high price tag.

As an attempt to accurately calculate the real production cost of gold, the World Gold Council has devised a new measure - 'all-in sustaining costs'. This includes maintaining the production setup and machinery and administrative costs. However, the calculation of 'all-in' cost is often manipulated by the gold mining companies by inflating their figures.

Ultimately it boils down to the fact that the worth of gold is what investors are willing to pay for it.

Though it is hard to predict the price of an asset in the future, based on the present trends, gold is expected to surpass $2,500 per ounce at some point in 2021. If not, in 2022. But it may have short-term setbacks that it is expected to recover without much effort.

Even as some industry experts predict the bullish trend in gold prices to continue for the next decade, others are painting a not-so-rosy picture. They are expecting a steady decline in the gold rate for the same period.

The World Bank is predicting the gold price to come down to touch $1,300 per ounce in 2030.

Bottom line

Gold is one of those assets that is not used up or consumed like other high-demand commodities such as crude oil or grains. Being a noble metal, gold doesn’t corrode, rust, or oxidize. All the gold that has ever been mined to date still exists and remains in someone’s hands. All that it may ever do is to change in form – a ring, a pendant, a coin, or a bullion bar.

Gold doesn’t earn interest or dividends like other investment alternatives. The profit that investors make when the gold prices soar remains notional as long as investors hold on to the asset. The real profit comes in only when the asset is sold.

The psychological and basic factors that affect gold prices are numerous. Some of them are unclear or unknown and are shrouded in mystery. Despite all the ambiguity and enigma surrounding gold, it remains the most favored asset, especially in troubled times. History is in its favor and stands testimony to its irrefutable position as an investment choice.